Till now the Lending Robot is treating your Bondora Portfolio as one big investment. This means all your Investements are rebalanced with the given Settings for Risk, Terms and Country selections. This was ok until I saw the introduction of Bondoras Go & Grow with the ability to create multiple accounts. I wanted something similar. Today I introduce the feature Sub-Portfolio which treats only a part of your entire Portfolio with the Lending Robot. You’ve now a possibility to try this Robo Advisor with a small amount, create a Portfolio for comparison reasons or just run it in parallel to the other Auto-Invests services.

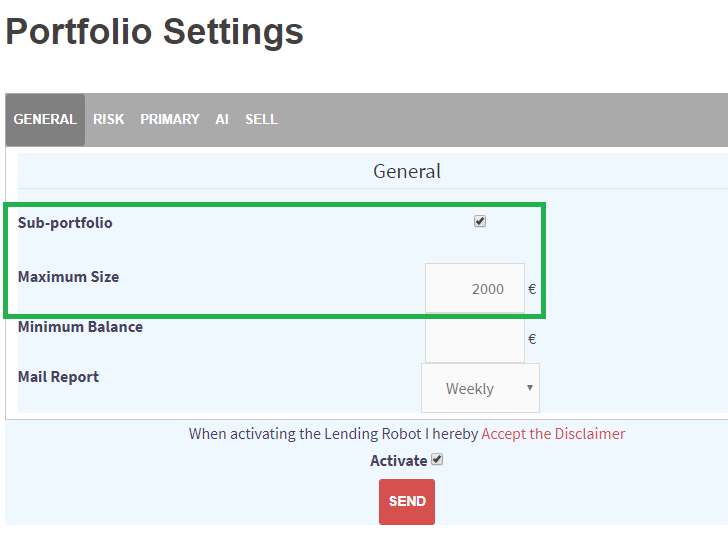

How can you configure this? The Settings contains a checkbox Sub-Portfolio. The amount of money to invest into this sub-portfolio is given in the field below Maximum Size. This is mandatory because only you know how much money shall be treated by the Lending Robot. The picture below is showing the Settings for a Sub-Portfolio with size of 2.000,00 €.

One point I want to mention: if you invest besides the Lending Robot with other Auto-Invests like Portfolio Manager, Portfolio Pro or Go & Grow they are competing each other on the same loan offerings from Bondora. My experience showed that Bondoras own products will win first because the Lending Robot doesn’t invest into the same loan twice. So if you’re starting from 0 first the Bondora managed investment will perform and the Lending Robot will follow slowly afterwards.

From my point of view this isn’t a big problem. I just want to highlight this competition of the different Auto-Invest possibilities and make this a bit transparent.