After quite some time and approaching the end of the year I present you the last Portfolio Overview for 2019. In September I showed you the last update which is now a quarter away. Not a bad timeframe and I suggest to keep this update frequency for Portfolio updates.

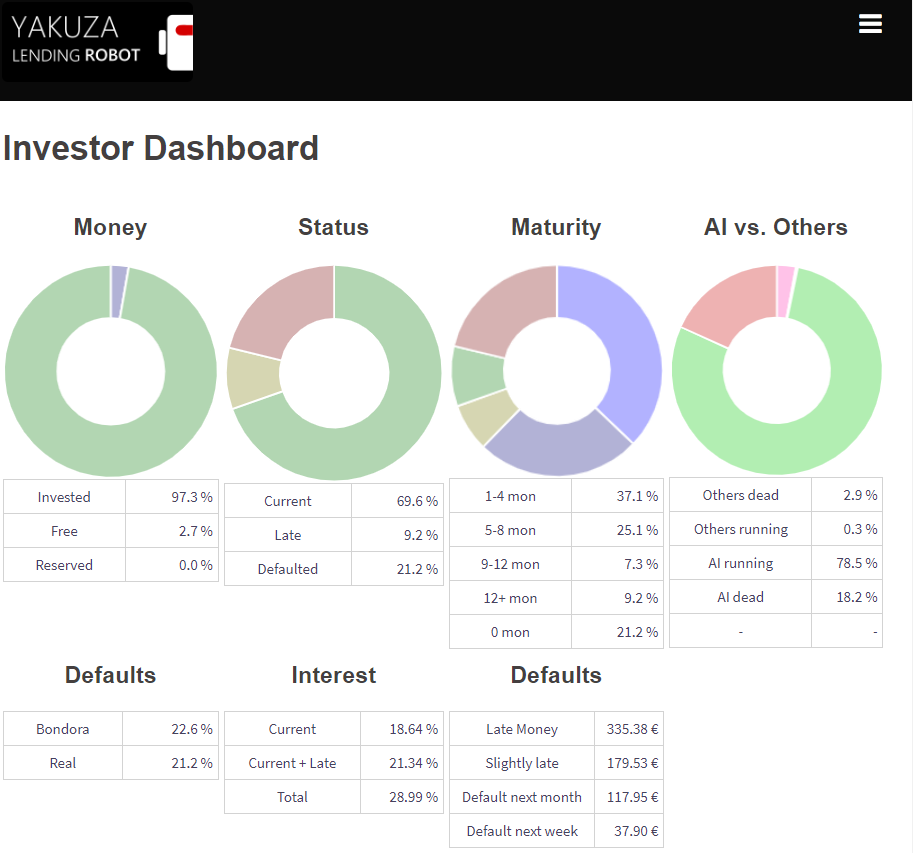

The defaults raised moderately the last three months. While defaults for non AI loans decreased by 0,4% to 2,9% the AI defaults raised by 1,6% to 18,2%. This is still below the overall prediction from 2018. Nevertheless the prediction from 2019 looks a bit worse. You can read more about this comparison in the blog entry AI Prediction 2018 vs. 2019.

Let’s have a look at the concrete numbers and check the differences from the last 3 months from September 2019:

| Description | Percent | Change |

| Default Rate of loans bought without AI mechanism | 2,9% | – 0,4% |

| Default Rate of loans bought with AI mechanism | 18,2% | + 1,6 % |

| Total Default Rate of the whole Demo Portfolio | 21,1% | + 1,2 % |

| Default Rate in the first year calculated by the AI Prediction | 15,1% | |

| Default Rate for overall lifetime calculated by the AI Prediction | 18,4% |

Further Links for more details to the Demo Portfolio:

- Portfolio Overview from the last month

- Prediction of the Demo Portfolio performed in July 2018

- AI prediction update: 2018 vs. 2019

- Access to the Demo Portfolio via Demo User Login

- Executing an own Prediction with the Dry Run

- All Portfolio Overviews in the Blog Posts