Today let’s have a look how the Portfolio performed in July.

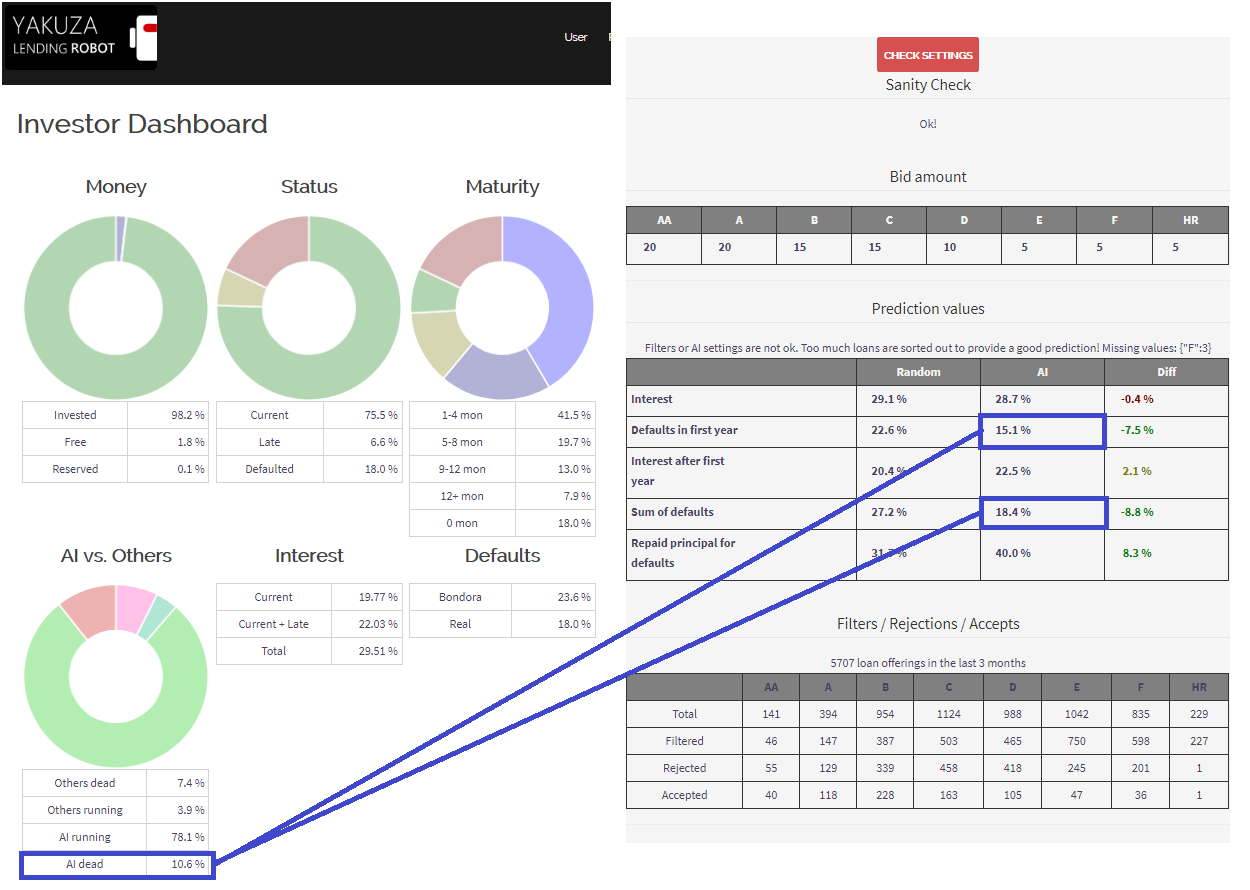

The big picture shows no major changes to June. Loan maturity stays nearly the same, late loans decreased by 3,1%, from this 1,4% are current again but 1,7% are gone into default state. So the important performance number of defaults raised from 16,3% to 18%. This can be splitted into 7,4% external loan defaults (bought without AI decision!) and 10,6% loan defaults which were bought with an AI decision. As already stated in previous posts I don’t have a clean AI Portfolio. Now theres the question “Is the default ratio as expected or not?”

What’s the expected AI default rate?

Let me forward you the the Dry Run section so you can test this by your own! Enter your Portfolio settings and check it regarding the expected yield, defaults and default recovery. I checked my Portfolio: with the actual risk and AI settings the past shows that 15,1% of the loans goes into default state in the first year. After the first year still defaults are occurring and they raised to 18,4% in total.

Now that I’m investing since exactly one year the AI dead rate shall be below 15,1% => this fits!

If in the future the AI dead rate stays below 18,4% I’m happy!

So for you my advise: Get your Portfolio prediction with the Dry Run and check your Performance values with the Investor Dashboard.