As promised I start today with my quarterly analysis of the Bondora Loan Default statistics. Due to the fact that this is the first analysis I’m going back a bit further!

TL;DR I’m a bit worried about Bondora’s Go & Grow share in F loans. Default rate from 2017 shows 49% defaults in the first year, 55% overall – for now!

Overall View

Everybody can download the Public Loan Dataset in Bondoras Public Report Area. In the default statistics 69.727 loans are evaluated. But 01.02.2019 exactly 77.408 loans were listed in the sheet. So why are not all of these loans evaluated?

Everybody can download the Public Loan Dataset in Bondoras Public Report Area. In the default statistics 69.727 loans are evaluated. But 01.02.2019 exactly 77.408 loans were listed in the sheet. So why are not all of these loans evaluated?

- 94 loans don’t have a risk rating

- 2.639 loans don’t have an entry for the Default Probability

- 4.948 loans have their first repayment date after 31.01.2019

Removing these from the list we have exactly 69.727 loans available for the default statistics!

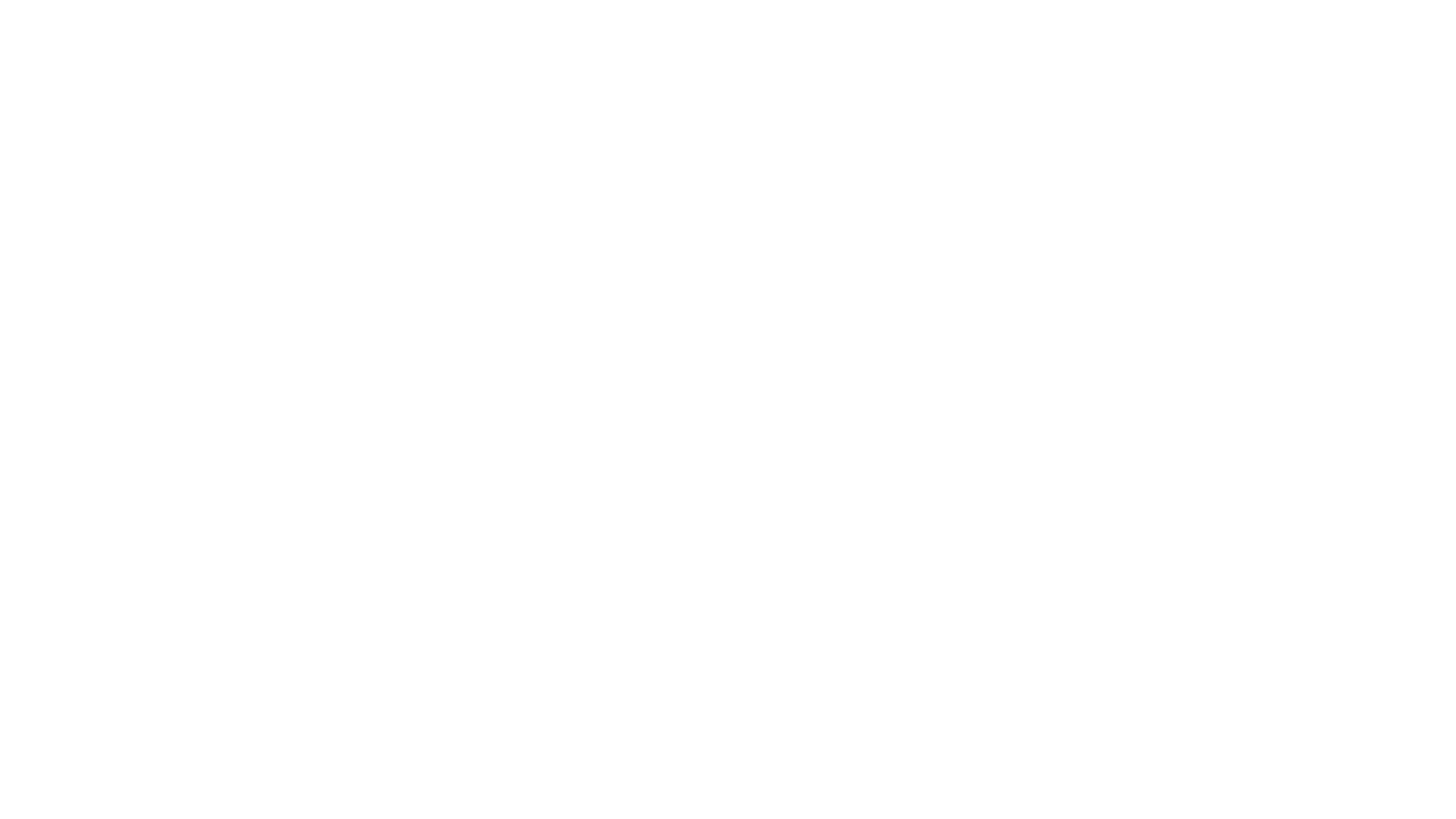

2019

January is over and that’s why the first loans of 2019 are shown in the stats which had their first payment day in January. As said above their are already loans with later payment days but they will be added on time in the right month. Of course no loan is defaulted so far in 2019, but I want to highlight 2 interesting points:

- There are more than 3.000 loans available with first payment date in January 2019. So the first estimate is that 36.000 public loans will be available in the year 2019. That’s a new record. I’m quite happy about this fact because it ensures a growing database of loans which feeds the AI with more and more input data. I’m not happy with everything in the Bondora API but it’s quite unique and absolutely nice to see that Bondora is sharing this database!

- The share of F loans increased to 1/3 of the total share. 2018 a complete different picture is shown. The statistics counts the number of loans, not the principal amount. Nevertheless this view fits to the actual Bondora Go & Grow Portfolio Distribution, which declares an actual 37% F loan share. In addition 17% E and 5% HR rated loans summing up to 59% share of rate E and lower! Looking at the latest available default rates (see 2017 section) Bondora seems to have great confidence in their borrowers and recovery mechanism!

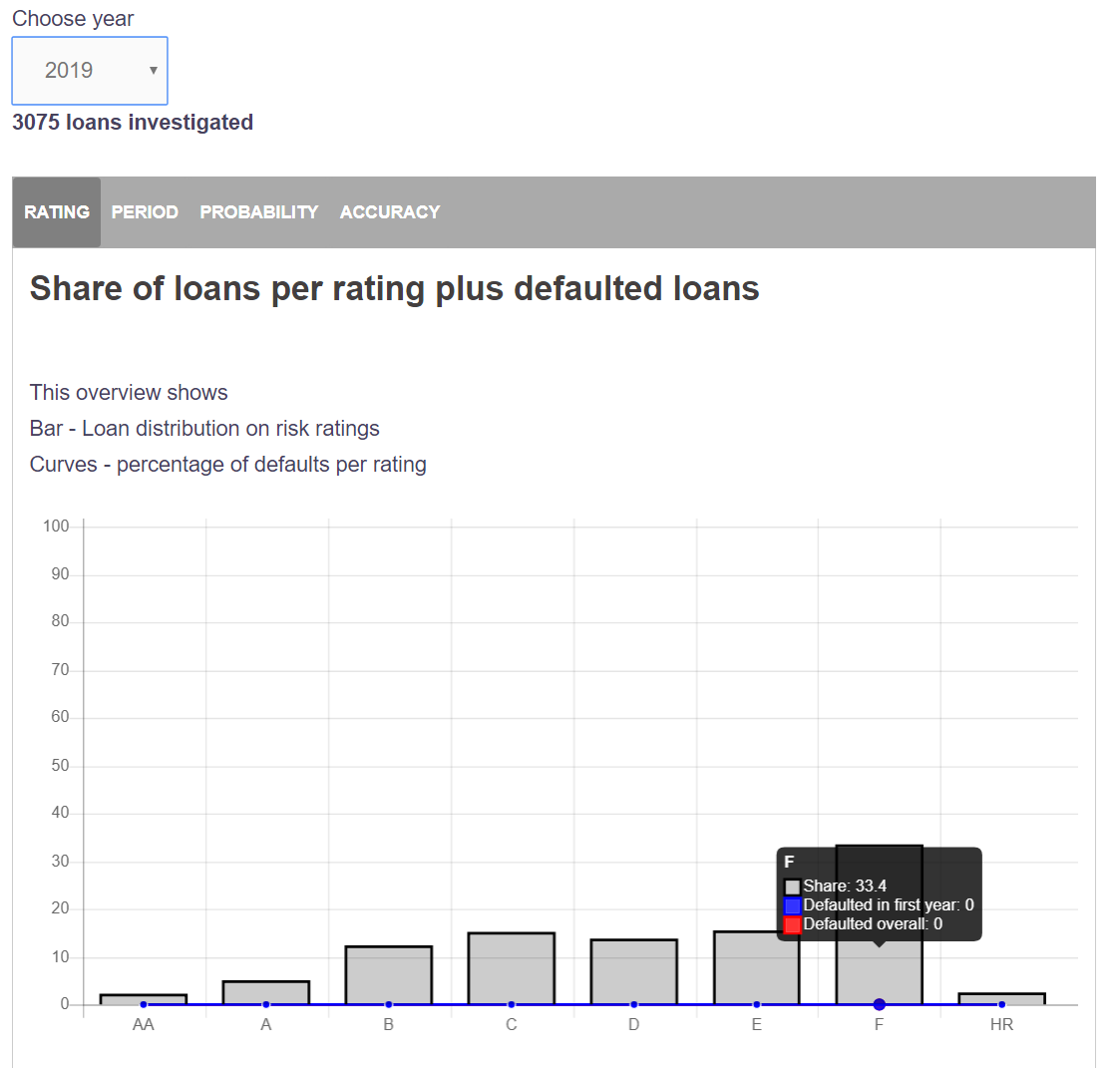

2018

Year 2018 is over, nevertheless not all loans are 12 months old. That’s why the blue curve will change month to month. Currently the curve looks a bit awkward.

- The default rates of AA and A loans are higher than B. Default rate for F is a bit higher than HR. I’m curious how this will develop in the next months but this finding surprised me a bit because this didn’t happened in the past. to give a better overview the default rates per rating are listed in the table below.

- The share between different ratings in 2018 was bell-shaped: AA & A nearly 10%, B & C with 35%, D & E with 34% and finally f & HR with 21%. Looking at the shares from 2019 in the section above F is far ahead and driven into a more risky section.

| AA | A | B | C | D | E | F | HR |

| 9,2% | 8,2% | 7,7% | 11,0% | 13,8% | 16,4% | 27,1% | 25,1% |

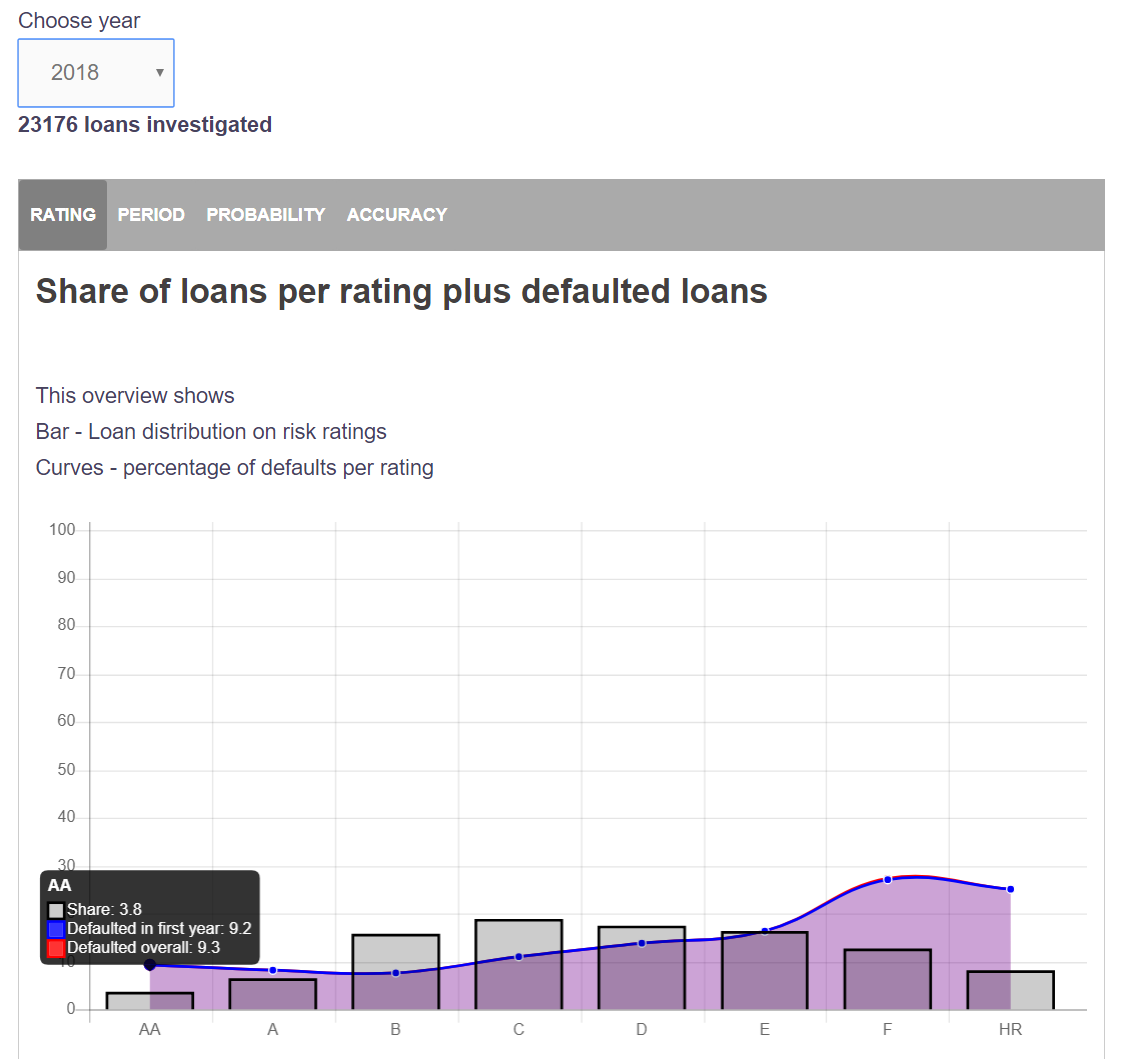

2017

From year 2017 all loans are now 12 onths and older. That’s why the blue curve (defaults within the first 12 months) will not change anymore. Only the red line (all defaults) will climb after further loans are going into default state. Let me highlight 2 points:

- The default rates in 2017 are quite high compared to the years before. AA defaults in the first year 13,2%, that’s high in my opinion. C with 25,9% defaults and F with nearly 49% default rate in the first year are also way higher than in the years before.

- The first point brings me back to 2019. Bondora Go & Grow Portfolio has a share of 37% F loans which doesn’t perform very well as mentioned right now. Let’s see if the default rates for 2018 are heading in the same direction as 2017