I’ve done some changes in the display of yout investments list. I’m talking a lot about loan defaults. The Lending Robot is aimed to reduce the number of defaults and the Dry Run shows also a higher recovery rate on defaulted loans. In July 2018 I published my Portfolio simulation. In my Portfolio Overview Posts this one is linked every time and compare the current default rate with the simulated one.

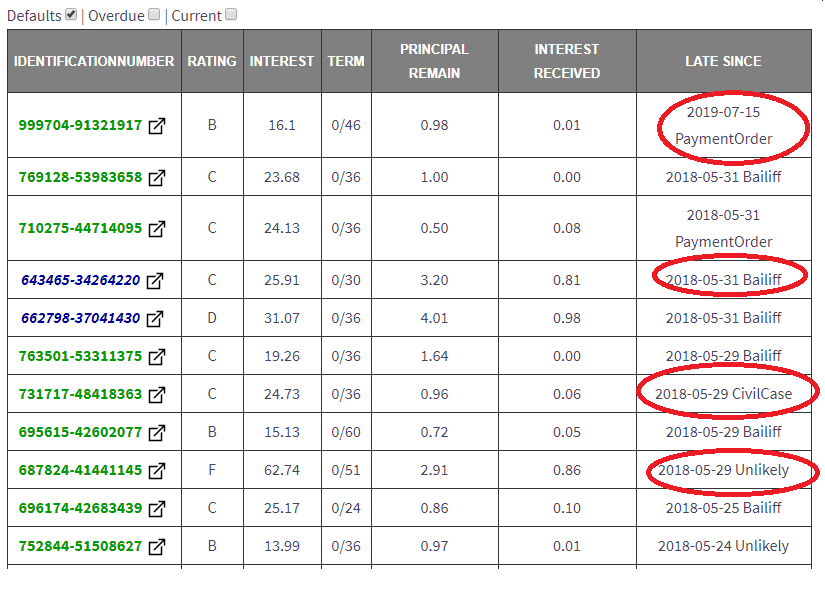

The current overview is missing the Debt Management State of the defaulted loans. Date is default is already displayed. Now the actual Debt Management state is showed additional the the loan default date. All different states are described on the Bondora API Docs.

Following Debt Management States are displayed in my investment list

- Payment Order – entry point of the recovery. After a few months the state shall change into the one of the next states

- Bailiff – “good” state, a person is performing some real actions to get your money back

- Civil Case – honestly don’t know how the recovery success performs in this case. I need more time to calculate this

- Unlikely – “bad” state, as the name states – bring back your money is quite unlikely