End of 2016 I started investing in P2P loans. One important criteria was the availability of an Auto Invest because I don’t wanted to start an active Portfolio management. Many platforms look similar, you’ll get 10% to 13% percent interest, buyback included. So no ratings, but diversification on many loans – fire and forget.

And then Bondora – easy Autoinvest, moderate settings promises about 15% interest, activate and …

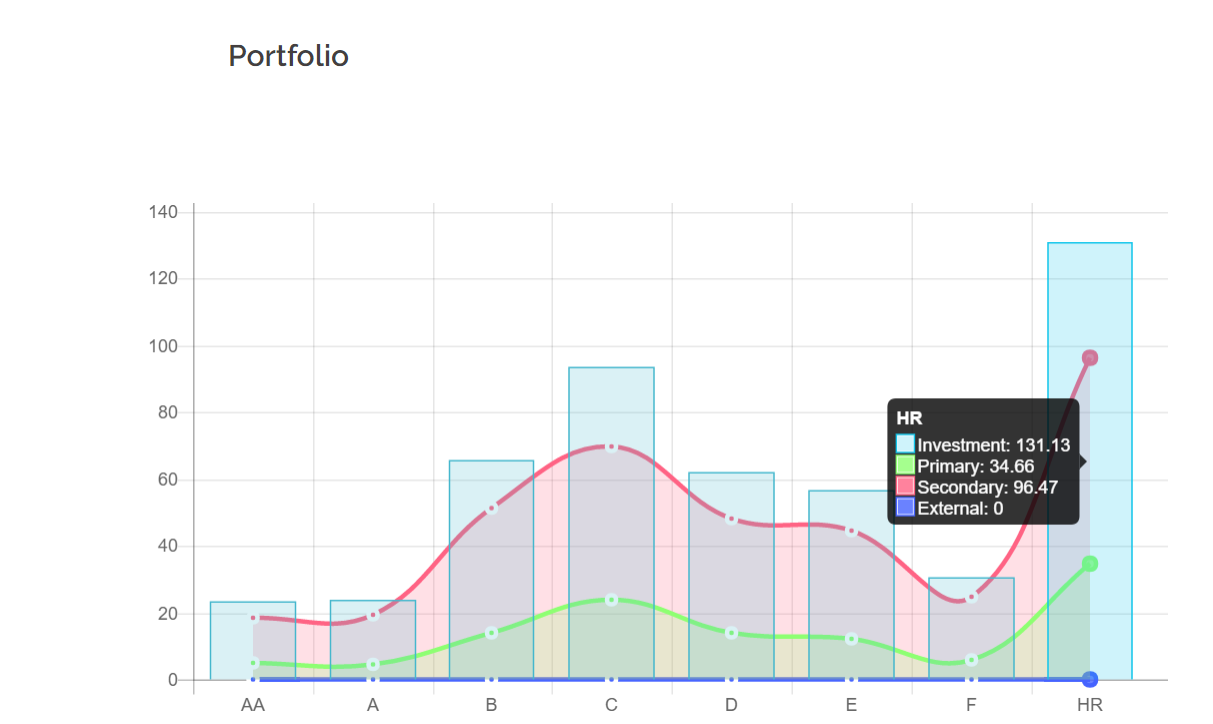

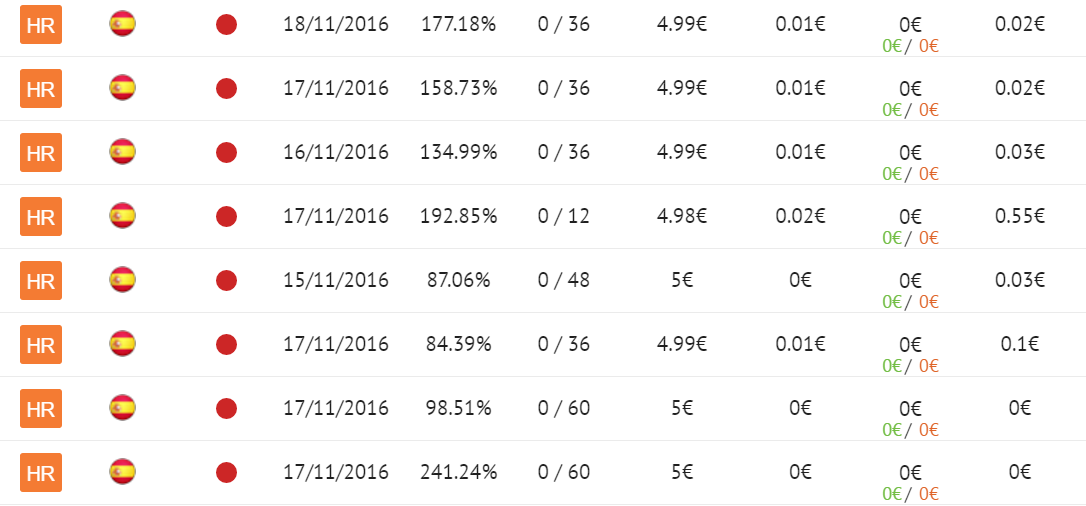

… 25% of my portfolio is filled with High Risk (HR) loans. As consequence the first loans are passing the 60 days late mark.

I was pissed! This platform was through! No additional investments and no re-invest here. Let it roll out and book it as “bad experience”.

Nevertheless you’ve to look to your portfolio from time to time. Then I discovered in some P2P Blogs the usage of the API from Bondora. I started with filtering requests using Postman and and I started to execute some scenarios. To which height I can raise the Interest until the filer returns no more results? How many loans are overdue? Can I find an intelligent pattern?

End of 2016 between Christmas and New Years Eve my first prototype of the Lending Robot was running based on the Secondary Market with rebalancing and buying loans. Very pleased about the firt success I asked myself – why not making a general web frontend with Portfolio Settings, Filters and nice graphhics. I started this journey and I dscovered many things to be done. Webserver setup, HTTP SSL configuration, Server certificates, Security, Database design, RESTful APIs, Cross-Oriigin Resource Sharing, … and finally a nice and tidy frontend design which is not my main area of expertise.

I started this journey and I’ll accomplish it!