Today we look back onto the Portfolio Performance from November. As in the previous Portfolio Post some things went fine while other loans causes some trouble.

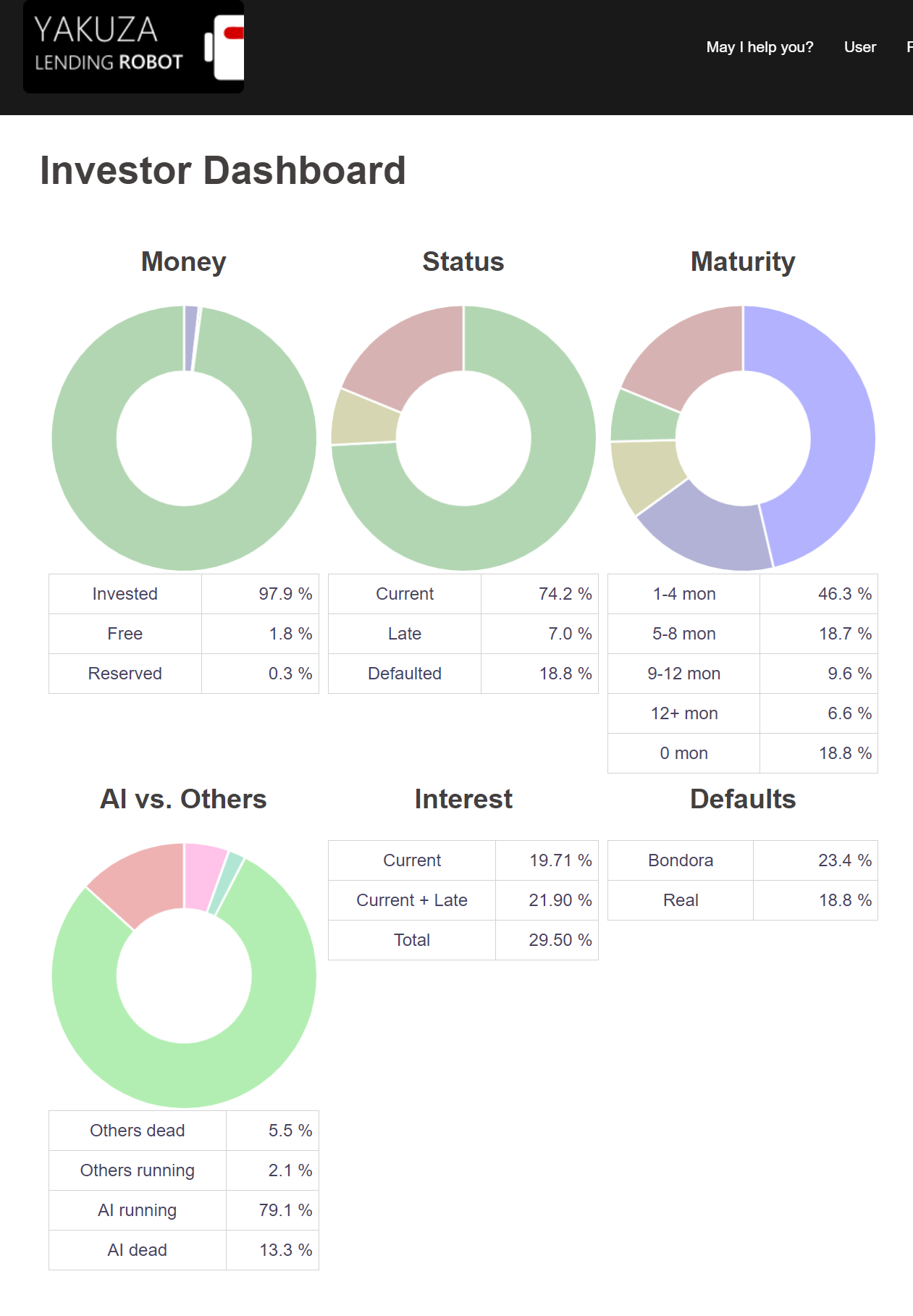

Positive: Debt collection and recovery looks ok. Last month the share of defaulted loans not bought with with AI dropped from 6% to 5.5%! Share of external loans decreased to 7.6%.

Negative: Some big F rated loans defaulted last month and increased the AI default rate to 13.3%. This is still below the one year prediction of the Dry Run which showed my a default rate of approx. 15.1% in the first year.

Overall the default rate raised by 0.5% to 18.8% right now.

By the way: Don’t forget my last Blog Post with the Demo User login data. With this you can check the values whenever you want!