Last Portfolio Overview was done a few months ago. And these months performed not so well. In August, September and now beginning October I observed many defaults. First half of 2019 I watched how the AI default rate raised slowly from approx 13% to 15%. That’s not surprising or unexpected, it’s still in range of the prediction. Now the default rate raised quite quickly from June to beginning of October to 16,6%. Still in the range of the prediction but I was a bit surprised by the quick increase. In parallel I can see on Mintos that interest rates are dropping, it seems in general interest rates are going down.

Let’s stick to the numbers and see how they evolved from June to now

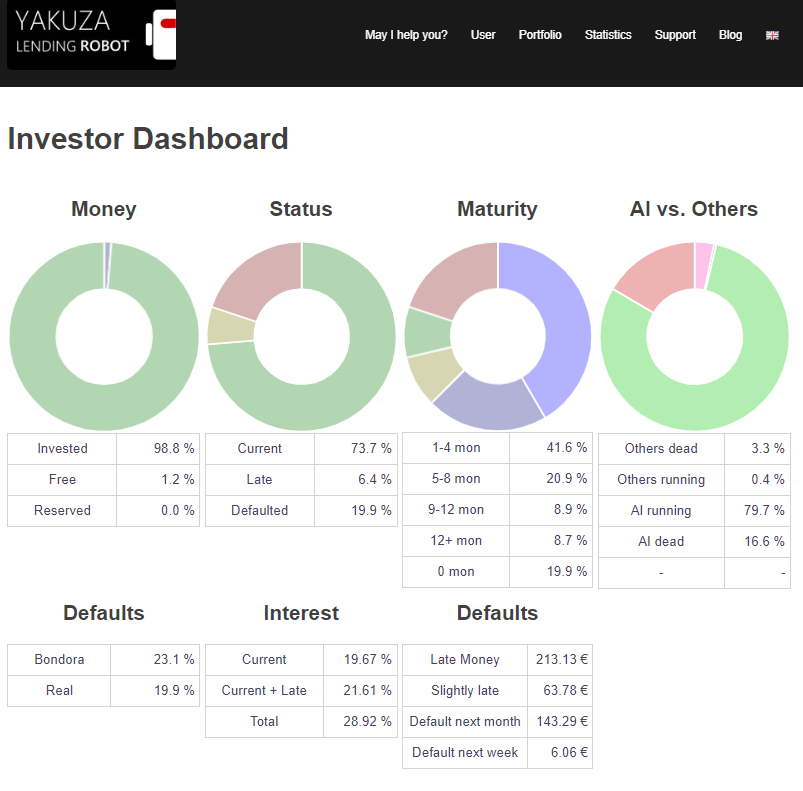

| Description | Percent | Change |

| Default Rate of loans bought without AI mechanism | 3,3% | – 0,8 % |

| Default Rate of loans bought with AI mechanism | 16,6% | + 2,0 % |

| Total Default Rate of the whole Demo Portfolio | 19,9% | + 1,2 % |

| Default Rate in the first year calculated by the AI Prediction | 15,1% | |

| Default Rate for overall lifetime calculated by the AI Prediction | 18,4% |

Further Links for more details to the Demo Portfolio:

- Portfolio Overview from the last month

- Prediction of the Demo Portfolio performed in July 2018

- AI prediction update: 2018 vs. 2019

- Access to the Demo Portfolio via Demo User Login

- Executing an own Prediction with the Dry Run

- All Portfolio Overviews in the Blog Posts