The Lending Robot is “running like a fine tuned machine“! You know this sentence? Ok, let’s get serious.

In the Motivation post I stated that the automated investement in Secondary Market loans is already in place. That’s true because it’s quite easy to handle. Query the loans which are on sale, sort according to one specific criteria (e.g. Interest) and buy loans – that’s it.

The Primary Market behaves different. After my first queries no loans were found. I recognized that just from time to time a loan auction is raised and after a few minutes it ends. So bidding on these auctions requires a different strategy. Also the processing after the bid requires attention. The money for a bid is not going into the investments directly. First money is reserved. The Robot has to check already placed bids to avoid multiple bids in one loan. And finally it’s still possible that the auction is cancelled.

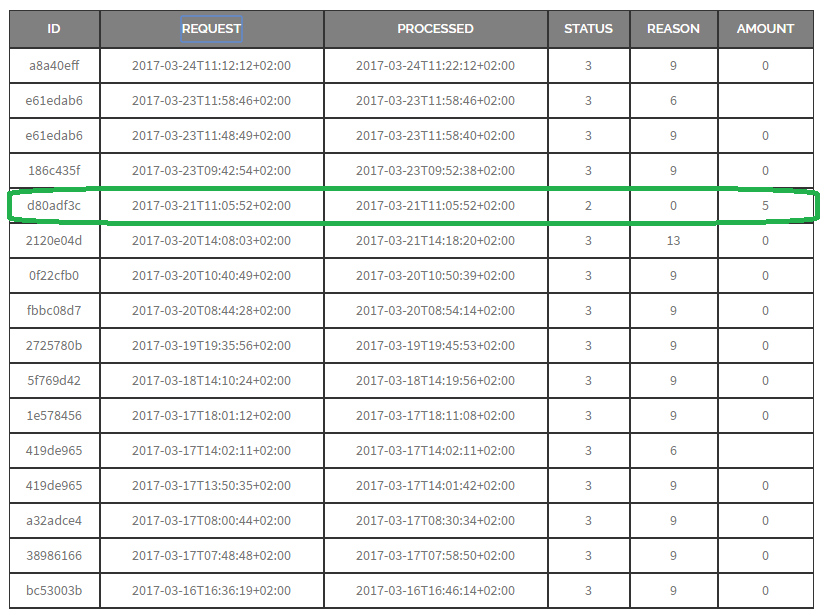

This processing is established right now and since 3 weeks I’m checking the behavior with my Bondora Account. The Processing works fine, nevertheless I’m dispappointed with the ratio Successful vs. Unsuccessful bids.

Only one bid was successful (StatusCode=2) while all other failed (StatusCode=3) for different reasons. After some research the answer can be found in a blog post from Bondora “Why isn’t the Portfolio Manager investing my funds faster?” which explains the competition in loan biddings. So I need to think about a strategy for adapting the investment amount based on the loan the rating.