Let’s have a look into the Demo Portfolio for the previous month:

- Investment of my money into loans performs well. 97.5 % of all the money is invested into loans, 2.5 % still to be invested

- Status shows the percentage based on the principal. 75 % are in state current, 8.7 % are late and 16.3 are defaulted

- Maturity shows the share how long the loans are running: 1 -4 months “Baby”, 5 -8 months “Young”, 9 – 12 months “Apprentice”, > 12 months “Adult” and of course the “Defaulted” loans

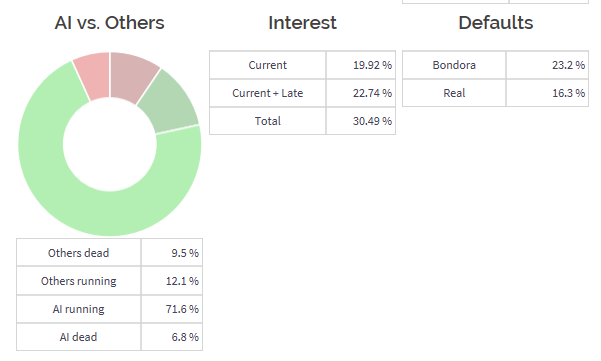

- Unfortunately I don’t have a Portfolio which consists of 100% AI loans. That’s why I introduce the “AI vs. Others” section. It shows the current / defaulted loans which are bought with AI against the current / defaulted loans without AI! So other loans have a total share of 21,6 % where 12.1 % are current but already 9.5 % are defaulted. That’s a bad value! The loans bought with AI looks much better: 78.4 % are bought with AI where 71.6 are current and only 6.8% are in state default. Looks much better!

- For interest 3 values are shown: “Current” shows the interest based on all investments taking only the current loans into account, “Current + Late”, as the name says, takes current and late loans into account while “Total” is the nominal interest of all your loans.

- The defaults table shows you the value of Bondoras “Probability of Default”, which is calculated for the first 12 months vs your real defaults. So for my investments Bondora calculated 23.2 % defaults within the first 12 months, real defaults so far are 16.3 %