Happy Easter to all investors!

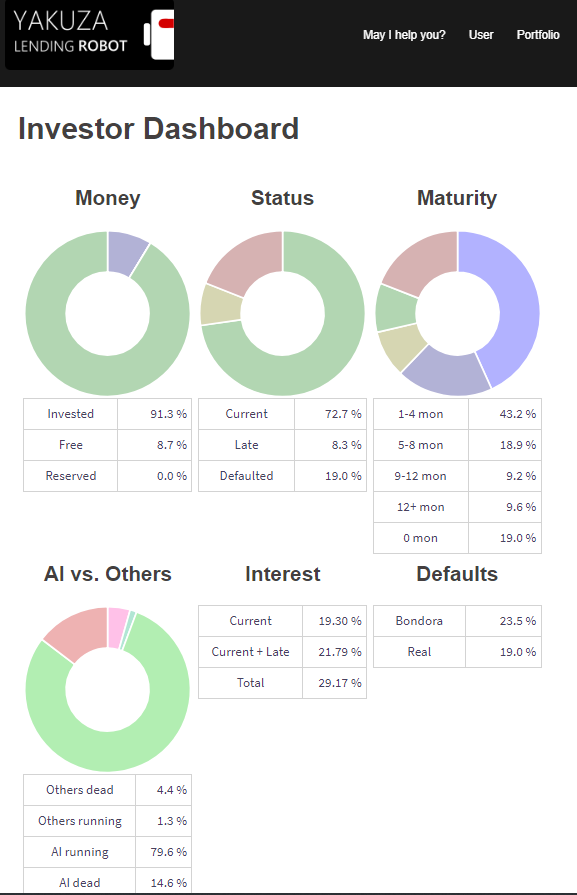

Today let’s look into the Portfolio Performance from March 2019. I extended the table with the changed values regarding the the previous month. So the changes are more visible. Of course the default for non AI loans goes down due to the running debt collection. On the other hand the rate is rising for loans bought with the AI mechanism, but still it’s lower than the predicted value:

The most important Performance Indicators:

| Description | Percent | Change |

| Default Rate of loans bought without AI mechanism | 4,4% | – 0,3% |

| Default Rate of loans bought with AI mechanism | 14,6% | + 0,5 % |

| Total Default Rate of the whole Demo Portfolio | 19,0% | + 0,3 % |

| Default Rate in the first year calculated by the AI Prediction | 15,1% | |

| Default Rate for overall lifetime calculated by the AI Prediction | 18,4% |

Further Links for more details to the Demo Portfolio:

- Portfolio Overview from the last month

- Prediction of the Demo Portfolio performed in July 2018

- Access to the Demo Portfolio via Demo User Login

- Executing an own Prediction with the Dry Run

- All Portfolio Overviews in the Blog Posts