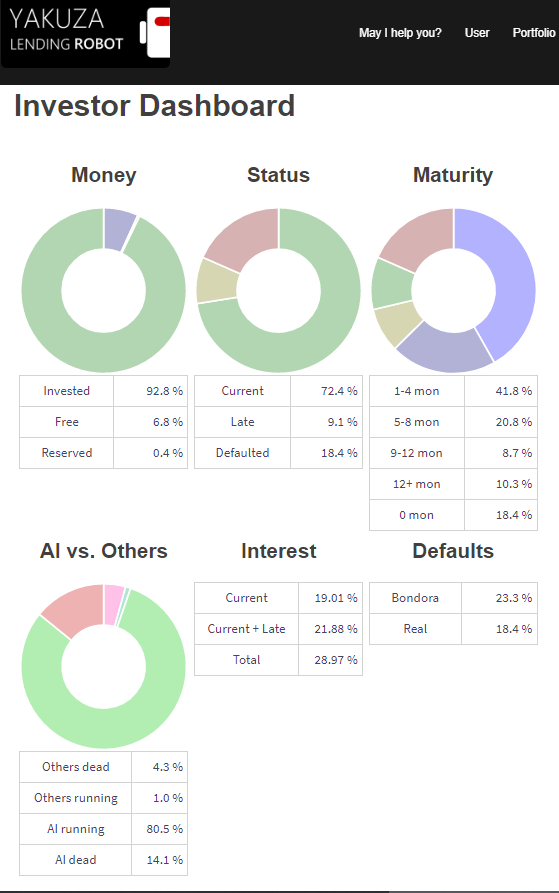

Let’s have a look on the Portfolio Performance from April 2019. Debt collection works quite well and money comes back! That’s why the total default rate is decreasing a bit. The share of loans which wasn’t bought by the AI mechanism decreases to nearly 5%.

The most important Performance Indicators:

| Description | Percent | Change |

| Default Rate of loans bought without AI mechanism | 4,3% | – 0,1 % |

| Default Rate of loans bought with AI mechanism | 14,2% | – 0,4 % |

| Total Default Rate of the whole Demo Portfolio | 18,5% | – 0,5 % |

| Default Rate in the first year calculated by the AI Prediction | 15,1% | |

| Default Rate for overall lifetime calculated by the AI Prediction | 18,4% |

Further Links for more details to the Demo Portfolio:

- Portfolio Overview from the last month

- Prediction of the Demo Portfolio performed in July 2018

- Access to the Demo Portfolio via Demo User Login

- Executing an own Prediction with the Dry Run

- All Portfolio Overviews in the Blog Posts