In my regulary Portfolio Overviews I highlight every time my actual total default rate. Sure, the Lending Robot shall decrease the default rate with a clever selection of loans. That’s why I keep an eye on the total defaults on my Portfolio. Even more interesting to compare the total Portfolio rate with the Prediction

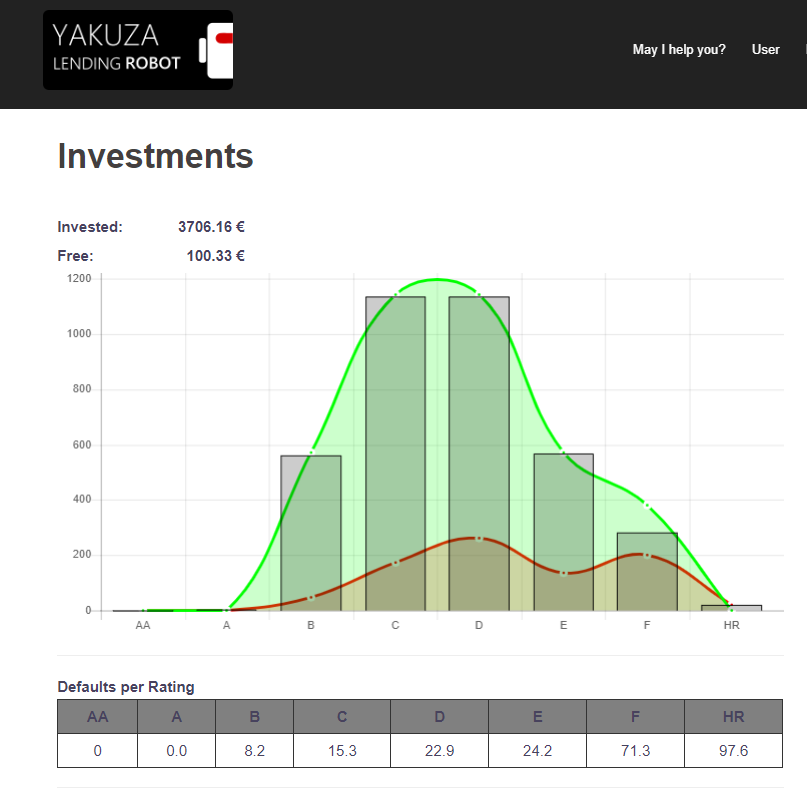

So far, so good. Missing ist still the detailed analysis which loans are performing better and which are perfroming latter. That’s why I added to the Investment view a table with the defaults per rating. It sows exactly the percntange of of defaults e.g. in your C-risk loans. This table can be easily compared with the Bondora Default Statistics. You can evaluate now if the Performance of the loans is higher or lower towards the default statistics.

I hope with this table you’re able to gain some information how to optimize your Portfolio Settings. Concentrate on better loans than investing on others! In one of my next posts I’ll get into this topics and I’m sure that that I will change my invstment strategy a bit!