Today I want to present you a different overview regarding my Portfolio Performance. Till now I presented (nearly) each month the changing numbers showing the evolving default numbers. Now I want to present 3 points with a bit more detailed description.

In short:

- Cashflow: Current Cashflow is 18,5 % from actual loans plus 2,6 % recovery from defaulted loans

- Default Rates: for all risk classes much lower default rates. F rated loans not really better

- Settings Change: Add AA & A ratedl oans, reduce F rated loans

The next sections will provide further details.

Cashflow

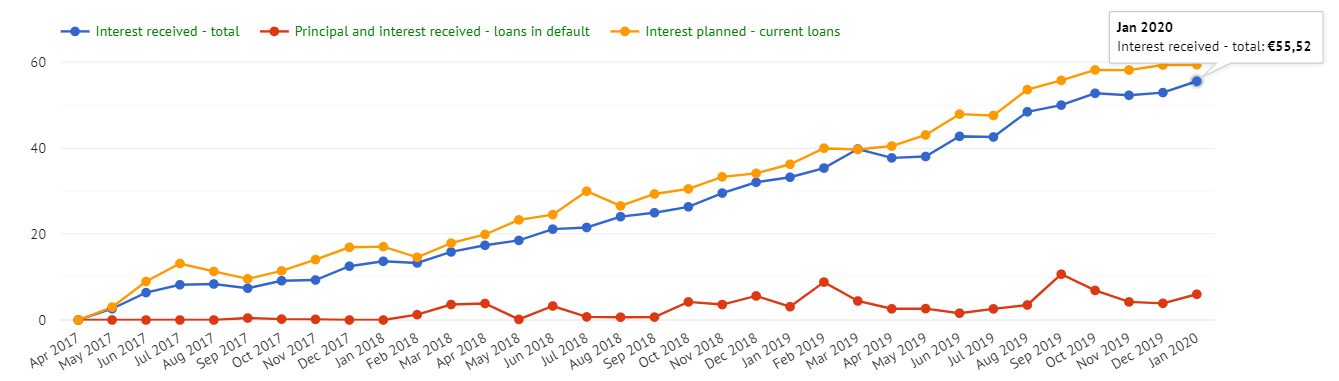

I’m quite pleased with the monthly Cashflow of incoming interest. January provides 55,52 € interest income from all current loans plus 5,99 € interest and principal repayment of defaulted loans. So you see over the time also the Collection & Recovery is doing it’s job and providing some Cashflow.

The numbers from the Dashboard are also sound. The current interest rate calculated on all loans is 18,5%. Losses from defaults are not taken into account. I didn’t found a way right now for a “good” prediction calculation. Nevertheless read Bondora’s Recovery & Collection Blog to see past and actual recovery rates.

Loan Default Rates

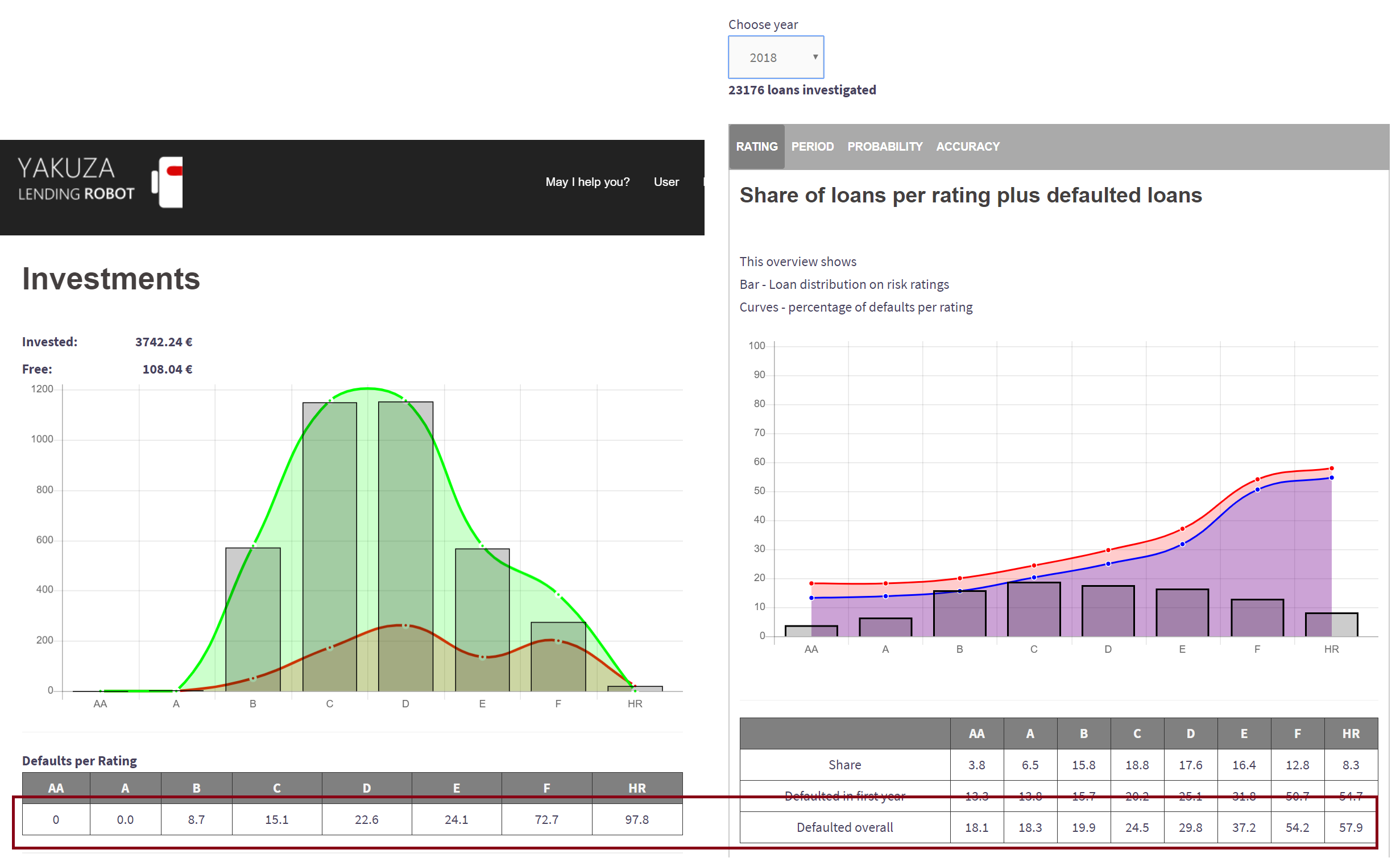

As a new feature in your Portfolio Investment List view you can see a table with the actual “Defaults per Rating“. This view helps me a lot. First I can compare my actual numbers with the official Bondora default statistic and as a second step to adjust my investment strategy.

The comparison of your actual Portfolio default rates with the Bondora default statistic is not that easy. The loans for my Portfolio are bought from April 2017 till now. I’ll take the stats from 2018 as comparison but feel free to do the same with the 2017 numbers. I’m very pleased with the default rates in the risk classes B to E. See the picture below – for every risk class much lower values e.g. E – rated loans actual defaults 24,1% while default stats states 37,2% – that’s 13,2% less defaults!

I’m not amused with the F – loans default rate. Since several months there are no more loan offerings which are fitting my filter settings – Estonia & Finland, max 36 months duration. Now only long running loans from Spain and Finland are available. That’s why the Lending Robot doesn’t invested in this rating and son the default rate raised to 72,7%. If the free money were invested into F – loans the default rate would lower to approx. 52% – also not nice in my eyes.

Strategy adjustment

For me the F rating is the new HR, the default rates are far too high! That’s why I will adjust my investment Settings the first time since the start of the Ykauza Lending Robot:

- AA and A rated loans will be a small part of the Portfolio – till now I avoided these two ratings

- F rated loans will be reduced

- HR rated loans will stay out

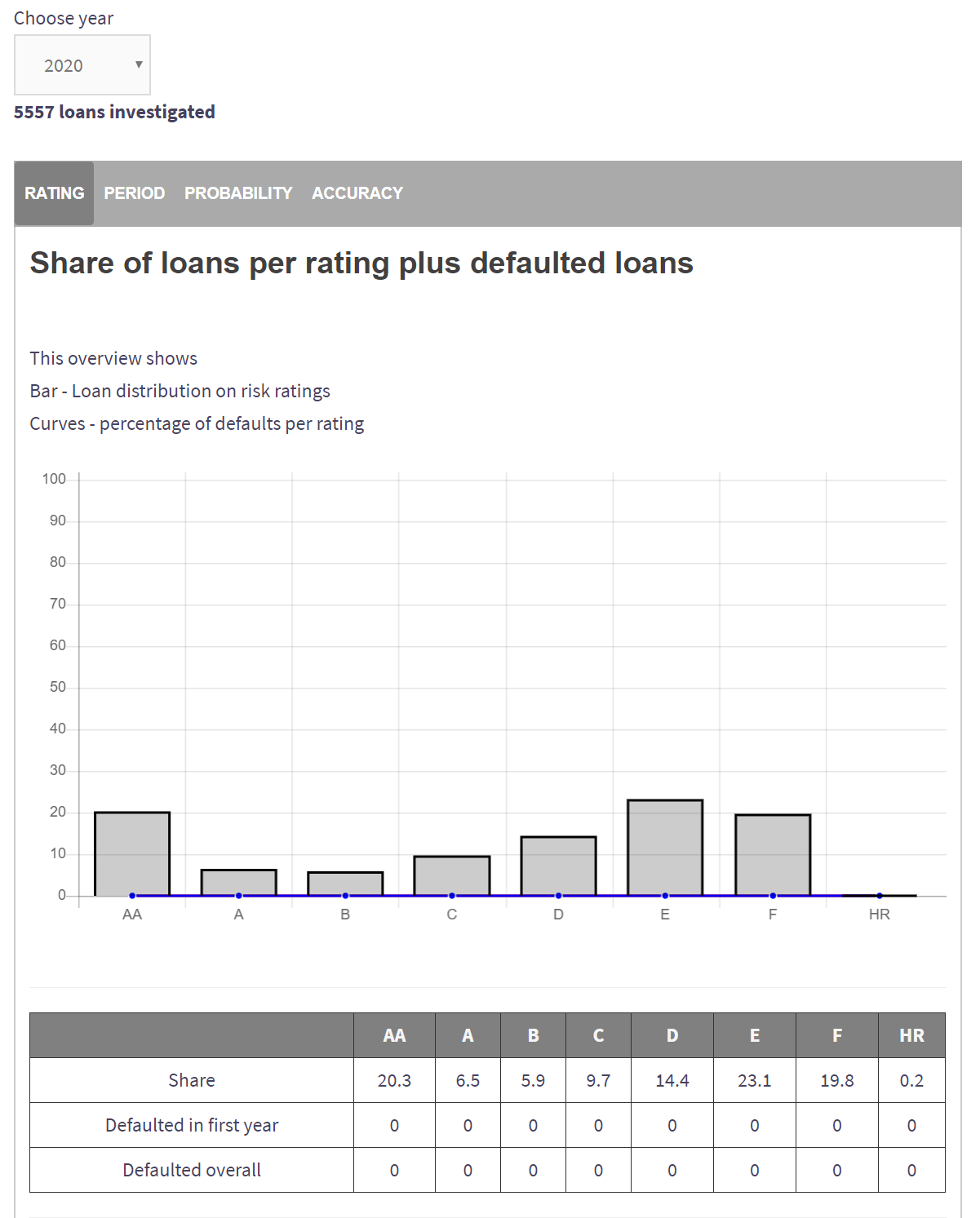

This fits also the the current loans offerings of Bondora. In January the AA loan share raises to 20%, on the other side no HR offerings!. Looks like Bondora wants to provide some counterbalance in contradiction to the high-risk loans. See the picture below showing the all loan offerings and the share between the different risk ratings.