After a long time I want to present you another update. Since approx 2 months I work in homeoffice. In principle I’m used to do this but such a long in a row I’ve never practised. Meanwhile I’ve the feeling I work more hours in homeoffice than being in office before. Besides that my Solar Energy Plant was installed on my home roof in March which urgently needs to be integrated into my Smarthome envrionment – just another project on my priority list. That’s why the Blog updates are behind but I’m still watching the functionality of the Lending Robot – and it works quite stable!

Now we are in “Covid-19” times and I’m thinking about my Portfolio. I decided to keep my investments into Bondora and also keep my weekly deposit. Nevertheless I’m recognizing only a few loans are transferred into the “default” state. I also recognized some loans which are more than 60 days overdue but still in state “overdue”. Unfortunately it’s not possible to identify via the Bondora API if these loans are marked with a “Moratorium“. I’ve already an idea how to implement a view for this and I really hope I can present this to you this month now it’s available!

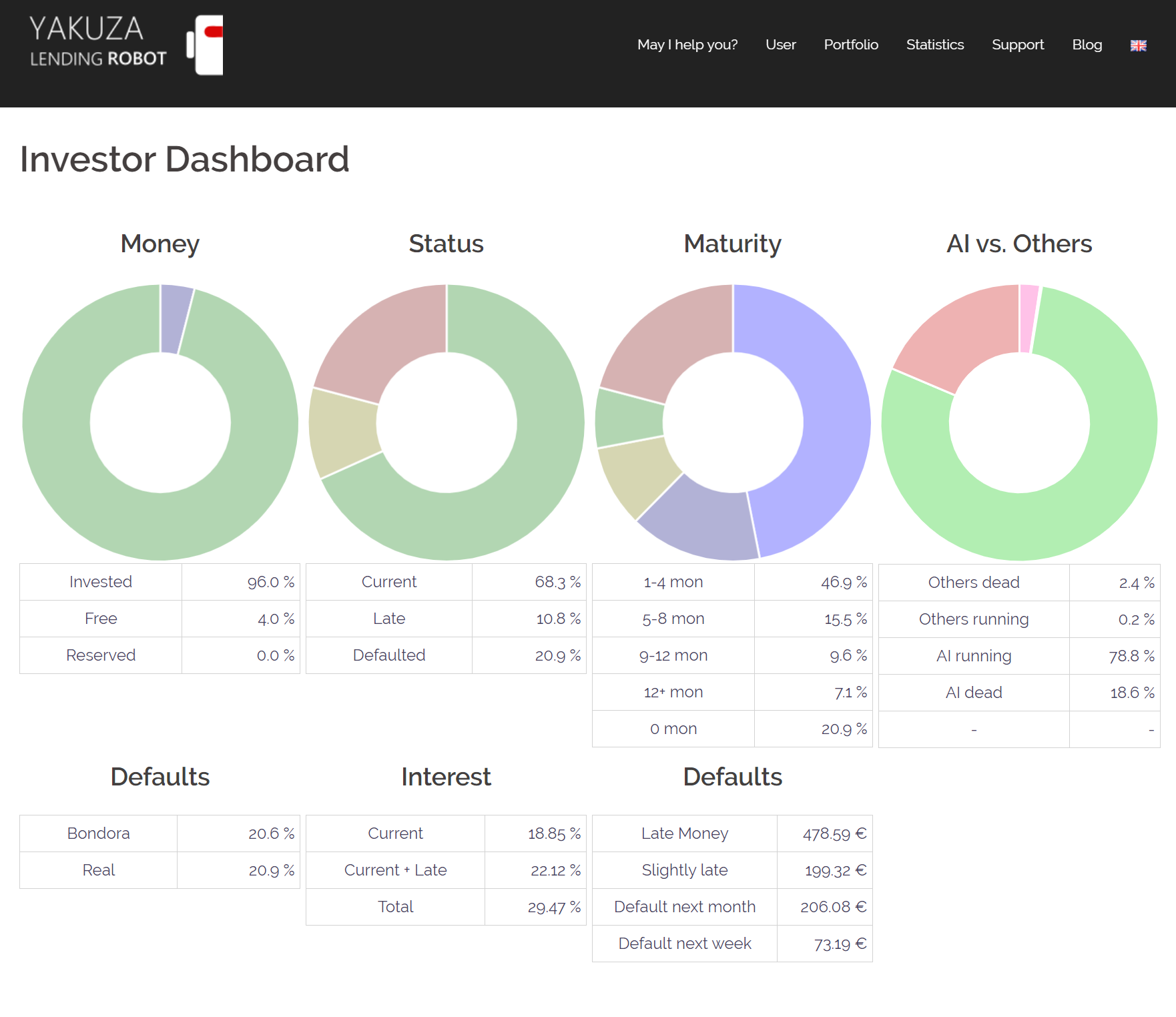

Let’s have a look into the actual numbers compared with results of the last Portfolio update from december

| Description | Percent | Change |

| Default Rate of loans bought without AI mechanism | 2,4% | – 0,5% |

| Default Rate of loans bought with AI mechanism | 18,6% | + 0,4 % |

| Total Default Rate of the whole Demo Portfolio | 20,9% | -0,1 % |

| Default Rate in the first year calculated by the AI Prediction | 17,8% | |

| Default Rate for overall lifetime calculated by the AI Prediction | 21,6% |

Further Links for more details to the Demo Portfolio:

- Portfolio Overview from the last month

- Prediction of the Demo Portfolio performed in July 2018

- AI prediction update: 2018 vs. 2019

- Access to the Demo Portfolio via Demo User Login

- Executing an own Prediction with the Dry Run

- All Portfolio Overviews in the Blog Posts