We’ve reached mid of July, nevertheless let’ have a look back how the Portfolio perfomed in June.

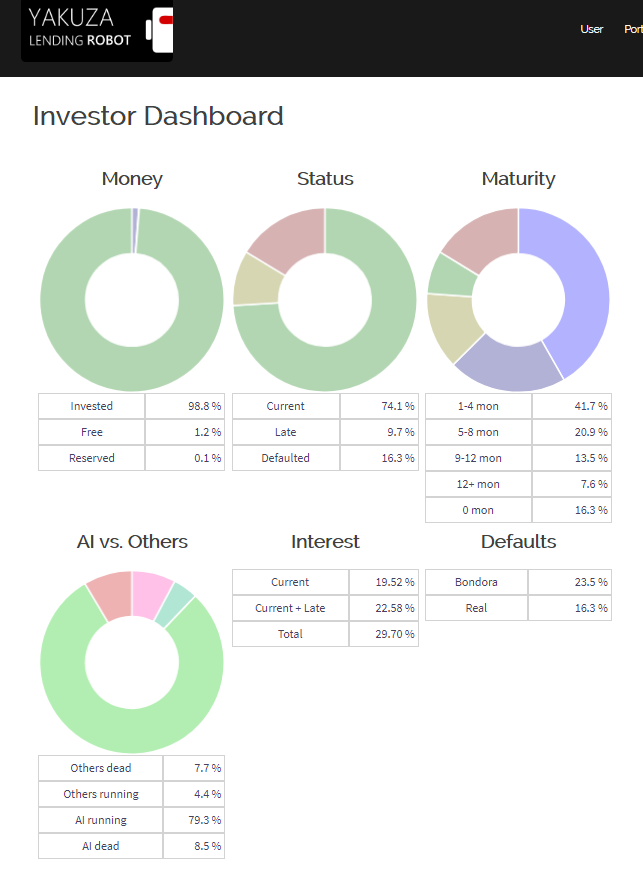

Only one loan is defaulted so far but I received some cashflow from previous defaulted loans. Based on the invested money the default rate drops from 16.9% to 16.3%. It’s high likely that this month some loans will switch into state default, because several loans are late more than 60 days. According to my database it’s about 2% of my investments. Nevertheless we’re still under the bounds of Bondoras calculated loss of 23.5%

The Maturity of loans is slowly going forward, e.g. loans older than 12 months switched from May 2018 3.9% to 7.6% in June!

The external investments, loans which are bought without AI, dropped to 12.1%