Exactly one year ago the Lending Robot bought the first loan with AI for my Portfolio. Still in test mode and the AI network was quite static. Nevertheless at this time I was able to check the AI settings with Games on the public loans from the past – I select 200 loans randomly and 200 loans based on AI. After that I calculate the default rate of both selections. And you know what – the AI selections performed quite better! Not regarding interest rate, but less default rates. Today this calculation is available for everybody via the Dry Run Page!

Besides that you can check regulary my Blog Page regarding the development of my personal AI Portfolio over the months.

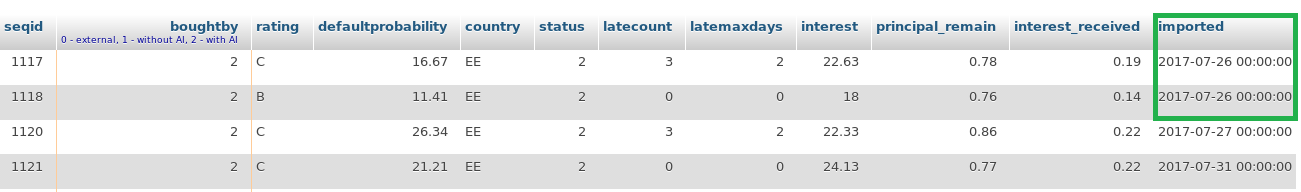

The snippet of m database shows you the first entries of my AI bought loans. Besides basic data provided by Bondora like Rating, Status and Interest Rate I calculate some additional values

- latecount – how often the loan was on delay

- latemaxdays – maximum days the loan was on delay

Second stage of the AI started in January 2018. The static network changed into a dynamic network. With this the Lending Robot can react better on changes of the underlying values.

I got many questions by Investors why they should give up their filter based investment rules and change to AI based investments. I don’t want to give you a detailed answer now because I’m working on stagge 3 and I want to file a patent first. If I explain this in detail before it’s not longer possible. But let me ask one question: Can you evaluate your filter settings on the public loans to check if these are really working out? The Dry Run here does it for AI!

Regardless if my Patent is accepted or not in future I’ll explain in detail how the Lending Robot is working. I just need some more time.